Paano Pumili ng Tamang Savings Accounts?

Pumili ng savings na bagay sayo! Alamin ang iba’t ibang savings accounts na pwede mong gamitin at ang mga benefits nila.

Saan nakalagay ang savings mo? Sa alkansya, kabinet o sa ilalim ng kutson parin ba? If yes, we won’t judge!

Pero, hindi ideal ang pagtatago ng savings sa bahay. Kapag nasa bahay, pwede siya magastos, manakaw, o mawala. Overtime, bumababa rin ang value niya dahil sa inflation.

So para hindi mawala o mabawasan ang value ng pera, it’s best to deposit it into a savings account. Because savings accounts earn interest, ito ang easiest, most accessible way to earn passive income.

Sa dami ng savings accounts out there, mapipilitan ka talagang mag-research to find the best one for you.

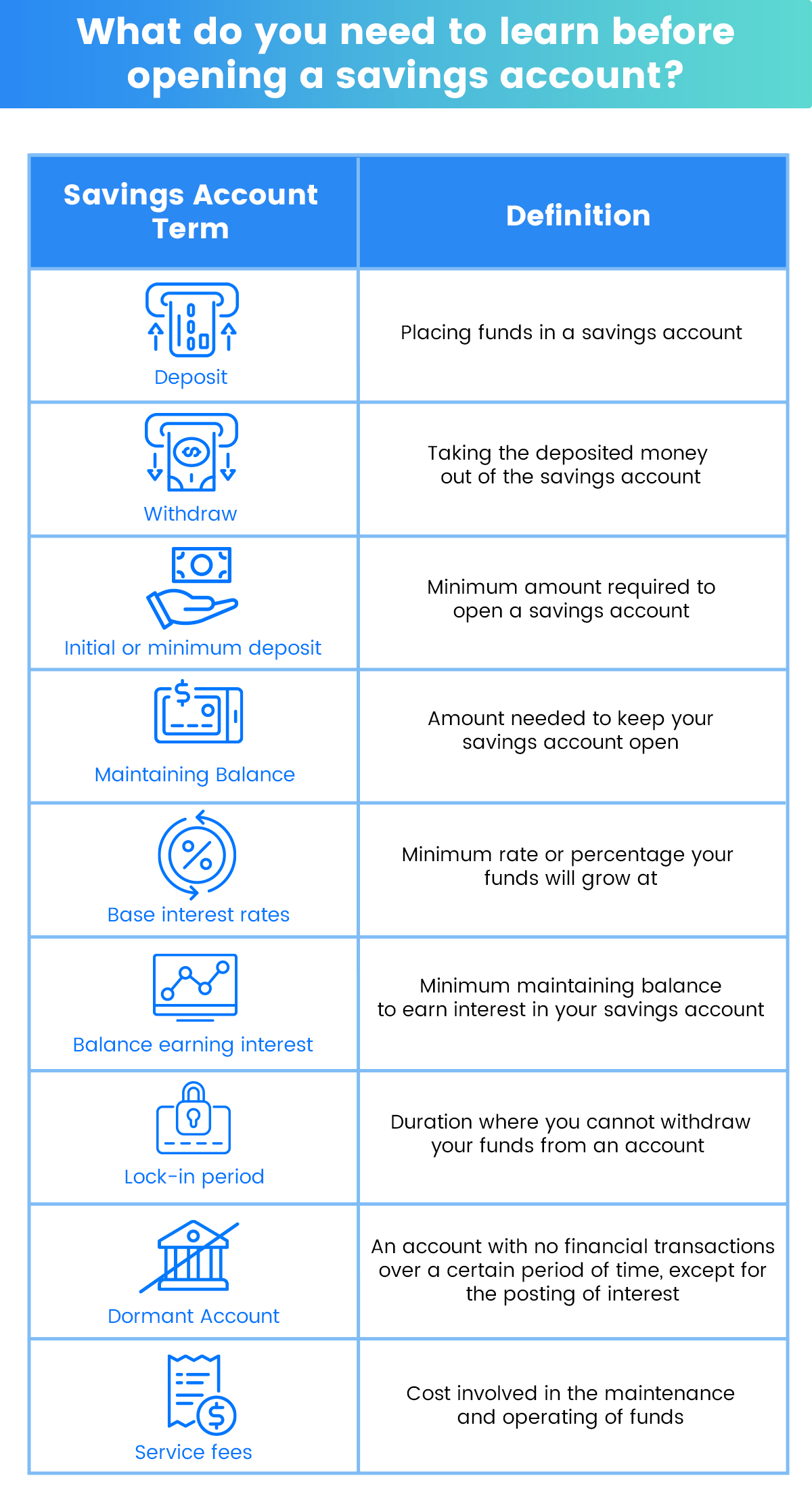

Aralin ang mga sumusunod na madalas gamitin ng mga bangko bago mag-sign up:

Maliban sa mga ito, dapat alam mo din ang:

- Track record ng Bank

Maganda alamin kung trustworthy ang bangko na paglalagyan mo ng pera. This will ensure na safe talaga ang pera mo sa kanila. May mga savings accounts din na may free insurance, credit card, personal checks, cash credits, o iba pang rewards. - Your personal saving habits

Gaano kadalas ka magdeposit o withdraw? Kung madalas, pumili ka ng account na minimal in terms of fees and charges.

With this in mind, heto ang iba’t ibang savings accounts na available sa Pilipinas ngayon:

Online savings account

Recommended for: first-timers, tech-savvy savers, at depositors na gustong kumita agad mula sa kanilang savings

Online savings accounts are offered by digital banks. From registration to withdrawal, lahat ng account management ay via online o mobile banking. Dahil kaunti lang ang kanilang operating expenses tulad ng rent at manpower, they can offer higher interest rates than traditional banks.

For first-time savers na nagde-develop pa lang ng saving habits, ideal ang online savings accounts. Walang charges o fees kung hirap kang mag-deposit regularly. Isang magandang halimbawa nito ay ang GSave sa GCash app.

Pros

- Mas mabilis mag-grow ang savings due to higher interest rates

- No minimum deposit, maintaining balance, and fees

- Accounts are managed online or via mobile banking

- Less requirements compared sa regular savings accounts

- Pwede kang gumawa ng account online

Cons

- No bank branches

- Withdrawals may or may not be possible via ATMs

- Transfers may not appear in real time

Regular savings account

Recommended for: account holders who prefer physical bank branches, at depositors na hindi concern ang pagkakaroon ng mataas na interest rate

Ito ang savings accounts from traditional local banks. Their average interest rates are around 0.1%-1%. Compared sa online savings, regular savings accounts are strict with fees pagdating sa maintaining balance at excess withdrawals.

Mas marami rin silang requirements to open an account. These are usually two valid IDs, proof of residence at income, at initial deposit.

Bagay ang regular savings accounts sa depositors na mas gustong mag-transact sa bank branches. However, most local banks now offer mobile at online banking. Mas madali rin ma-access ang funds from regular savings accounts na may ATM cards.

Pros

- Pwedeng pumunta sa bank branch for transactions or assistance

- Accounts can also be managed online or via mobile

- Pwedeng mag-withdraw through ATMs

- You can issue checks if you choose a checking type of account

Cons

- Lower interest rates compared sa online savings accounts

- Pwedeng makain ng fees at charges ang iyong interest earnings

- Maraming requirements bago makapag-open ng account

Time deposit accounts

Recommended for: depositors na hindi kailangan mag-withdraw any time soon

Time deposit accounts are accounts na mataas ang interest pero may lock-in period. Depending sa pinili mong time frame, you need to maintain your money sa account for 30 days, 60 days, 180 days, o 1-7 years. To withdraw before the end of the lock-in period, most banks require you to meet with a bank representative. May malaking penalty din ang early withdrawals.

Pros

- Pwedeng pumunta sa bank branch for transactions or assistance

- Accounts can also be managed online or via mobile

- Pwedeng makakuha ng high interest rates

- Limited ang access sa savings to ensure it grows

Cons

- Non-flexible at mahirap i-withdraw in case of emergencies

- Maraming requirements bago makapag-open ng account

- In case of early withdrawal, makakain ng malaking penalty ang earnings

Specialty savings accounts

Recommended for: depositors na may specific goal na pinag-iipunan

Specialty savings accounts are designed for specific goals. Some examples are savings accounts for kids, OFWs, college funds, o property downpayment. Maraming special features ang mga ito na hindi available sa regular savings account. Some of them have low initial deposits, free insurance, o automated transfers.

Pros

- Helps you save for a specific financial goal

- Depending on the account, you can enjoy special features

Cons

- Some accounts have strict withdrawal and deposit policies

- Depending on the account, madalas ay mababa ang interest rate

- Limited to specific groups such as OFWs and students

Real talk: Ano ang best savings account?

Online savings accounts ang may highest interest rates. Therefore, kikita agad ang iyong savings in a shorter period of time. Madali rin itong i-manage using your mobile

In summary, choose an account that fits your saving habits, immediate needs, and saving goals! Kapag may savings account ka na, mas madali mong mabi-build ang habit of saving.

Ngayong marunong ka na magsave, ang next step ng iyong investment journey ay Investing 101! Dito mo matututunan kung ano ang investing at paano nito mapalalago ang iyong pera!

Next Article: Investing 101

Gusto maging mas wais sa pera?

Alamin ang iba pang Usapang Pera articles para sa dagdag kaalaman tungo sa mas madiskarteng paghawak ng pera