Protect yourself and your family through an affordable comprehensive insurance product of Life, Personal Accident (PA), and Daily Hospital Income (DHI) insurance!

Select active GCash customers will be notified through a text message and the balance will be autodeducted from their GCash wallet balance upon availment of the product.

G-Xchange, Inc. is the distribution channel of GCash Insure and does not hold any responsibilities in terms of any claim payment under this insurance.

ENSUREMEPH INSURANCE BROKER, INC. (InsuranceKo) is providing administrative and distribution services under GCash Insure.

AXA PHILIPPINES is the underwriter of GCash Insure and is responsible for payment of all valid claims.

TERMS & CONDITIONS

What is GCash Insure?

GCash Insure is a comprehensive insurance product of Life, Personal Accident (PA) and Daily Hospital Income (DHI) insurance that is sold through GCash. It is an innovative offering for GCash customers which provides valuable financial protection in the event of hospitalization, accident, and/or death.

Who can avail GCash Insure?

-

- Select GCash customers, within the age limits of 18 to 64 years, can avail of GCash Insure upon payment of a nominal premium.

- For dependents of married members:

- Legal spouse within age limits of 18 to 64 years – the legal husband/wife of the insured under the Policy who has not yet attained his/her 65th birth anniversary.

- Children/young adults aged between 3 and 21 years

-

-

- For dependents of single members:

- Parents who have not yet attained his/her 65th birth anniversary.

- Siblings who are at least 3 years old but have not attained their 22nd birth anniversary and who are wholly dependent upon the insured individual (member) for support.

How can I avail of GCash Insure?

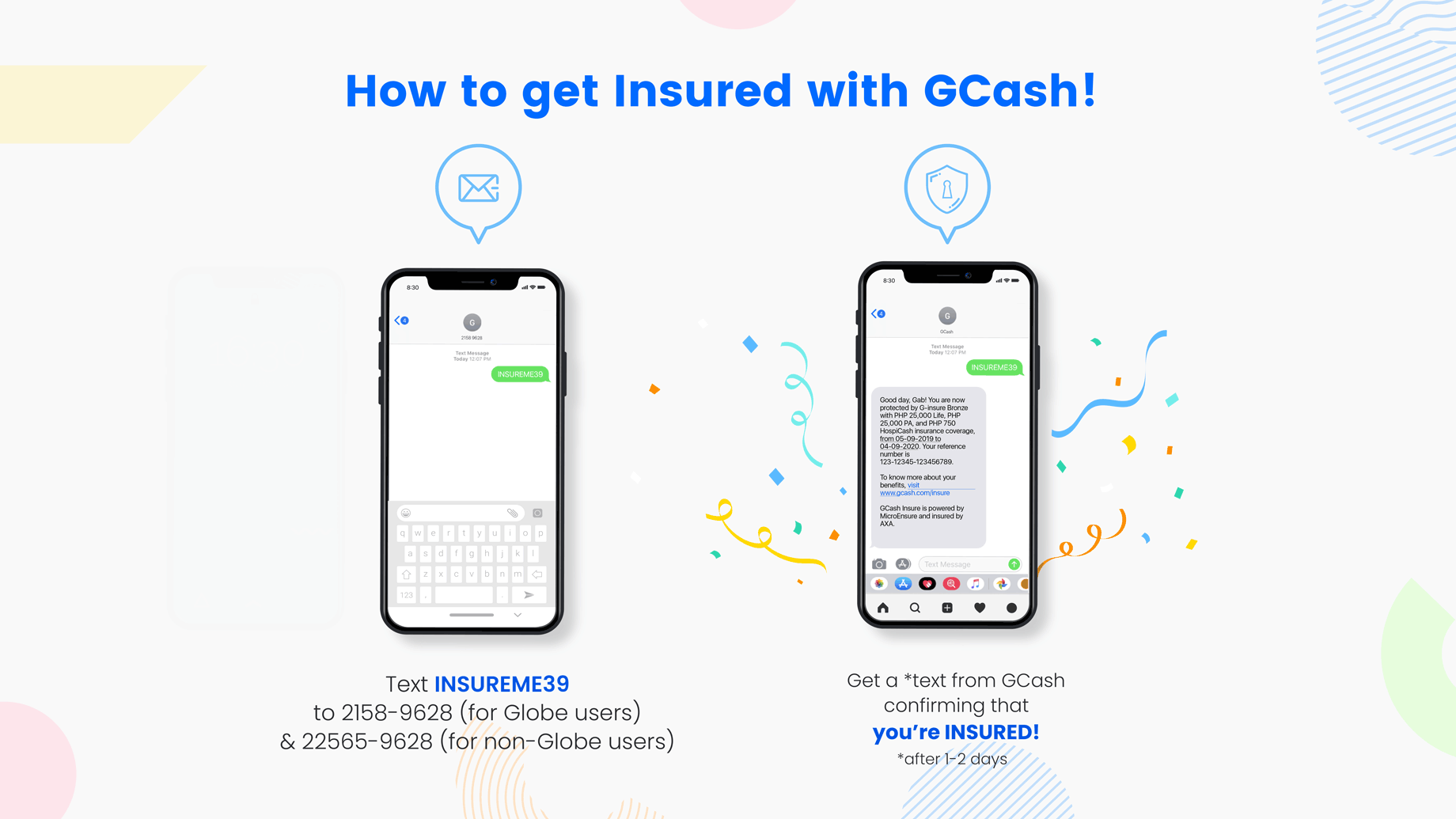

Availing of GCash Insure is easy and convenient. Send us an SMS of the code of your desired product and we’ll do the rest. Payments and policy activations are processed afterwards. Say goodbye to long lines and lengthy forms!

How do I pay for my insurance product?

Once you send your SMS, we will deduct the amount from your GCash account. This should take about a day to reflect. Every month, the same amount will automatically be deducted from your account. But don’t worry–you can cancel anytime.

Can I purchase an insurance policy for someone else?

For now, you may do this by purchasing a family policy. We’re working on being able to do this soon so stay tuned!

How may I view information about my cover?

You should receive a text with basic information about your active policy within 1-2 days. If you need more detailed information about it, you may send us a request by filling up this form https://form.jotform.com/InsuranceKo/GCashInsurance_Support.

This also works in the event that you lose your policy information.

How can I renew my GCash Insure?

Your subscription is automatically renewed every month. The monthly subscription amount will be deducted from your GCash wallet on each cutoff date!

If you want to stop your subscription, you may email us any time to cancel and we’ll get right on it.

I missed my renewal payment, what do I do?

All you have to do is load/top-up your GCash account as soon as possible. It’s important to make sure you have funds in your GCash wallet so we deduct the payments from there.

Don’t worry–you will have a 30-day grace period for renewals. Your cover will terminate at the end of the grace period if premium remains unpaid.

Can I cancel my GCash Insure?

Yes! You may cancel your GCash Insure subscription any time you wish. We can even refund the monthly amount in full if you cancel within 15 days after your initial enrollment date as long as you haven’t made any claims.

What benefit is provided under GCash Insure?

For each person covered:

|

TERM LIFE INSURANCE |

PERSONAL ACCIDENT INSURANCE |

HOSPITAL CASH INSURANCE |

| BRONZE |

Php 25,000 |

up to Php 25,000 |

up to Php 750 |

| SILVER |

Php 50,000 |

up to Php 50,000 |

up to Php 1,500 |

| GOLD |

Php 100,000 |

up to Php 100,000 |

up to Php 5,000 |

| PLATINUM |

Php 200,000 |

up to Php 200,000 |

up to Php 10,000 |

For hospitalization, the benefit plan is paid PHP 250 for each day spent in a hospital as an inpatient due to sickness or injuries. To claim this benefit, you must have spent a minimum of three days in the hospital as an inpatient. Hospitalization due to sickness is only payable if it occurs after the 15-day waiting period.

For Personal Accident, the following table can be used as reference:

| Description of Disablement |

Percentage of the Maximum Benefit |

| Loss of the limbs |

100% |

| Loss of both hands, or all fingers and thumbs of both hands |

100% |

| Loss of both feet |

100% |

| Total loss of sight of both eyes |

100% |

| Injuries resulting in being permanently bedridden |

100% |

| Any other injury causing permanent total disablement |

100% |

Can I assign beneficiaries?

This is possible under the death benefit you can claim under our Term Life and Personal Accident Insurance. If there is no beneficiary designated by the Member or if there is no designated beneficiary surviving at the time of such payout, the following persons will be designated to receive the benefits, in the following order of preference:

- Surviving spouse

- Surviving children

- Surviving parents

- Surviving brothers and sisters

- Estate executor or administrator

When will my coverage start?

Your coverage under GCash Insure starts the moment you receive the confirmation SMS from GCash upon collection of applicable subscription from your GCash account.

The insured member and dependents (if any) will only be eligible for a death benefit or hospital benefit after a 15-day waiting period from the start of his/her coverage, if death or hospitalization is due to sickness. No waiting period shall apply for death and hospital confinements due to accidents.

Can I go to any hospital?

You can go to any nearest registered hospital in the Philippines to seek treatment and receive the full benefits of your insurance.

A registered hospital means that an institution that is:

- licensed to provide medical care in accordance with the laws of The Philippines; (b) is primarily engaged in providing diagnostic and laboratory tests, medical evaluations, medical treatment & services and surgical facilities;

- has 24 hours-a-day nursing service by registered graduate nurses under the permanent supervision of in-house Physicians in charge;

- maintains proper in-patient facilities with documented protocols and procedures; and

- maintains a daily medical record for each of its patients, which is readily accessible to the insurance company.

Will I be paid the benefit if I seek treatment from a clinic?

To get the complete benefits of your insurance coverage, it is highly recommended that you visit a registered hospital. Unfortunately, admission to a clinic will not be considered under this plan.

What is the price for GCashInsure?

You can avail of GCash Insure for as low as ₱39 a month! You may also choose to upgrade to our other plans for higher insurance coverage.

| INDIVIDUAL (covers 1 person) |

|

Monthly Premium |

Annual Premium |

| Bronze |

Php 39.00 |

Php 468.00 |

| Silver |

Php 78.00 |

Php 936.00 |

| Gold |

Php 220.00 |

Php 2,640.00 |

| Platinum |

Php 440.00 |

Php 5,280.00 |

| FAMILY (covers 3 persons) |

|

Monthly Premium |

Annual Premium |

| Bronze |

Php 117.00 |

Php 1,404.00 |

| Silver |

Php 234.00 |

Php 2,808.00 |

| Gold |

Php 660.00 |

Php 7,920.00 |

| Platinum |

Php 1,320.00 |

Php 15,840.00 |

When will my coverage under GCash Insure terminate?

Your GCash Insure protection policy may terminate for several reasons:

- If you choose to cancel your subscription.

- If you fail to pay for your subscription after the 30-day grace period. It’s a good idea to always have some balance in your GCash wallet for this!

- If you attempt to make a fake claim under GCash Insure. Don’t be a fraudster!

- Upon the attainment of your 65th birthday. Don’t worry, we’re finding ways to insure a wider age range soon.

- If GCash stops offering this product to its customers. We’ll let you know about this in advance.

- For your dependents, their policy terminates when you either (1) choose to terminate the policy they are enrolled in or *or (2) when they reach their 22nd birthday (for children/siblings)

Can I have multiple policies?

For now, only one policy is allowed per user. If you want to get better coverage benefits, you may upgrade your plan by texting the code of the plan you wish to upgrade to! If you happen to have multiple active policies and there is a claim, the claim must be filed against one policy only.

If I have a question about GCash Insure, what number should I call?

You can contact the GCash hotline at 2882.

What is the claims procedure?

Claims are quick and easy. Inform us about your situation and send over your documents to gcashinsure-support@insuranceko.ph

For injuries and death claims, you may inform us by filling up this form https://form.jotform.com/InsuranceKo/GCashInsurance_Support. Just tell us about your situation and follow the steps given.

Digital and/or physical documents will be identified to complete documentation, depending on the event.

For hospitalization claims, just follow the steps given below when you are admitted in a hospital seeking treatment:

- For your hospitalization, kindly notify us by filling up this form https://form.jotform.com/InsuranceKo/GCashInsurance_Support. In the event you cannot claim this in person, your relatives accompanying you in the hospital can do this for you. Someone from our team will reach out and guide you about the claim process.

Arrange following documents to file a claim:

-

- Hospital record showing date of admission, discharge, diagnosis and treatment given;

- A government issued valid ID of the insured person and the beneficiary; and

- If hospitalization is due to accident, violence, attempted self-destruction, police and medico-legal reports

will also be required.

The claims settlement may take 10 days, starting from the date of receiving complete documentation.

Claims may be disbursed through GCash OR through other channels made available by the underwriter.

If I want to cancel my GCash Insure cover or make a complaint, what number should I call?

You can cancel your GCash Insure within (15) fifteen days of purchase and send a request for cancellation by filling up this form https://form.jotform.com/InsuranceKo/GCashInsurance_Support. Full premium paid will be refunded to you provided you have not made any claim under GCash Insure. You can also file a complaint using the same process.

What are the exclusions?

The following cases shall not be eligible for benefit payment

- Self-inflicted injury, suicide or any attempt threat; or

- Strike, riot, civil commotion, acts of terrorism, revolution, insurrection, declared or undeclared war, or any warlike operation; or

- Any illegal act committed by the insured (murder, theft, drug-related crime, etc.)

- Childbirth and female reproductive illnesses