Marami sa atin ang napapaatras na agad pagkarinig ng salitang ‘budgeting’.

“Nakaka-limit mag-budget.”

“Hindi ako magaling sa math.”

“Kahit anong budget ko, hindi ako makakaahon sa utang.”

So bago kami magpatuloy with Budgeting 101, let’s make sure that you have the right mindset.

The right mindset for budgeting

Lahat tayo ay may money beliefs from friends, family members, and life experiences. Ang money beliefs mo ba ay tulad ng nasa taas? Then you’ll notice that they are limiting and even paralyzing. They tell you na hindi mo kayang mag-budget dahil wala kang pera o kakayahan.

Thus, we need to evolve from these beliefs to be successful at starting and maintaining a budget. Magagawa natin ito by developing a growth mindset. If you’re willing to learn new skills such as budgeting, then you’ll eventually achieve financial stability!

Instead of believing na nakaka-limit ang budgeting, think of it as a way to free yourself from money anxiety and stress. By knowing exactly how much you can spend, hindi ka na magugulat pagdating ng iyong bills, at hindi ka magi-guilty whenever you treat yourself. Like all skills, you’ll also get better at budgeting the longer you practice. As you master your expenses, makakapaglaan ka na ng cash to pay your debts, and build savings or investments.

Budgeting, simply put, is making a plan for every peso you have. Kaya’t kung ready ka nang bigyang-halaga ang bawat piso ng iyong income, read on!

What do you need to start budgeting?

-

A budgeting app, spreadsheet, or online budget calculator

While you can use pen and paper, budgeting online or with an app is easier. It also gives you a better chance to stick to your habit. Check out these free basic tools! May designated fields at automated computation na ang mga ito. Ilalagay mo na lang ang corresponding amounts.

However, feel free to look for other online resources na babagay sa iyong financial situation.

-

- Apps. Money Lover (iOS/Android), Money Manager (iOS/Android), Monthly Budget Planner (Android)

- Online resources. Money Lover web version, Consumer Finance PDF budget template, Mint XLS budget template

-

Your financial statements and paperwork

These are documents related to your income and expenses. For example are payslips, bills, loan statements, at bank transactions. Parte ng budgeting ang pag-compute ng iyong average monthly expenses. Thus, these documents will come in handy.

Make a budget in 5 steps!

Step 1. Alamin ang iyong regular monthly income

If you’re a regular employee, then this is your take-home pay every 15th at 30th. Self-employed o may ibang source of regular income such as freelance projects? Then simply add your earnings after tax sa iyong income.

Step 2. Ilista ang iyong monthly fixed at variable expenses

Using your recent financial documents, ilista ang lahat ng expenses mo in a month. Then, hatiin ito into two categories.

- Essential expenses. These are important expenses na hindi mo pwedeng i-delay every month. Examples are groceries, rent, utility bills, internet, at insurance o loan payments.

- Wants. Ito ang non-essential expenses related to leisure and entertainment. Examples are food deliveries, personal care items, entertainment subscriptions, at online shopping.

Step 3. Total your monthly income and expenses

Equal ba o mas mataas ang iyong income than monthly expenses? Good job! This means that you are living within your means. More importantly, may extra kang pwedeng ilaan for savings, debt payment, at iba pang financial goals.

Mas mataas ba ang iyong expenses than income? It means you are overspending. But that’s okay! Kailangan mo lang mag-adjust sa ibang areas ng iyong spending.

Step 4. Mag-assign ng amount for your expenses

Now that you know your expenses, assign an allowance for each category. Simply duplicate your list of expenses at mag-assign ng enough amount para sa susunod na buwan.

Start with your essential expenses, then your wants. If wala ka pang savings o emergency fund, then we also suggest making an allowance for “surprise expenses”. This is para hindi ma-exceed ang iyong monthly budget in case of emergencies.

Do you need to lower your expenses para mag-match to your income? Then check if you can lower your spending in the following categories.

Wants

Try to spend less on shopping and consumable vices. Examples are cigarettes, apps, or gym subscriptions. Do you have streaming services like Netflix o Spotify? See if you can downgrade or share a plan with other people.

Phone bill

Review your phone use and see if you can still downgrade your current postpaid plan. Prepaid user? Try cheaper load promos or a sim card with non-expiring data.

Food and groceries

Reduce the number of times you get takeout or delivery. Later, you can also cut down on the frequency of your grocery trips. Ito ay para hindi ka ma-tempt to buy more items.

Not sure how much to budget per category? Mag-estimate based sa average ng latest payments mo in the last three months. As you assign amounts, try to make your total monthly expenses equal or less than your income.

Step 5. Maglaan ng extra income for savings or investments

Done budgeting amounts para sa iyong expenses? Then it’s time to build your savings and investments!

Ideally, 20% of your monthly take-home salary should go to your savings. Ito ay ayon sa 50/30/20 budgeting guide ng Harvard bankruptcy expert na si Elizabeth Warren. The remaining amount will go to your living expenses (50%) and non-important expenses (30%). Magandang starting point ito especially if you’re new to saving and investing.

You may also visit Savings 101 or Investment 101 for a more in-depth guide.

How to use your budget

Congratulations, nakagawa ka na ng simpleng monthly budget! It’s time to follow, track, and update it as you spend for the next month.

For best results, record your expenses on your budget tracker daily. It will take a few minutes and prevent you from overspending. Also, makikita mo agad kung naaabot mo na ang iyong spending limit in each category.

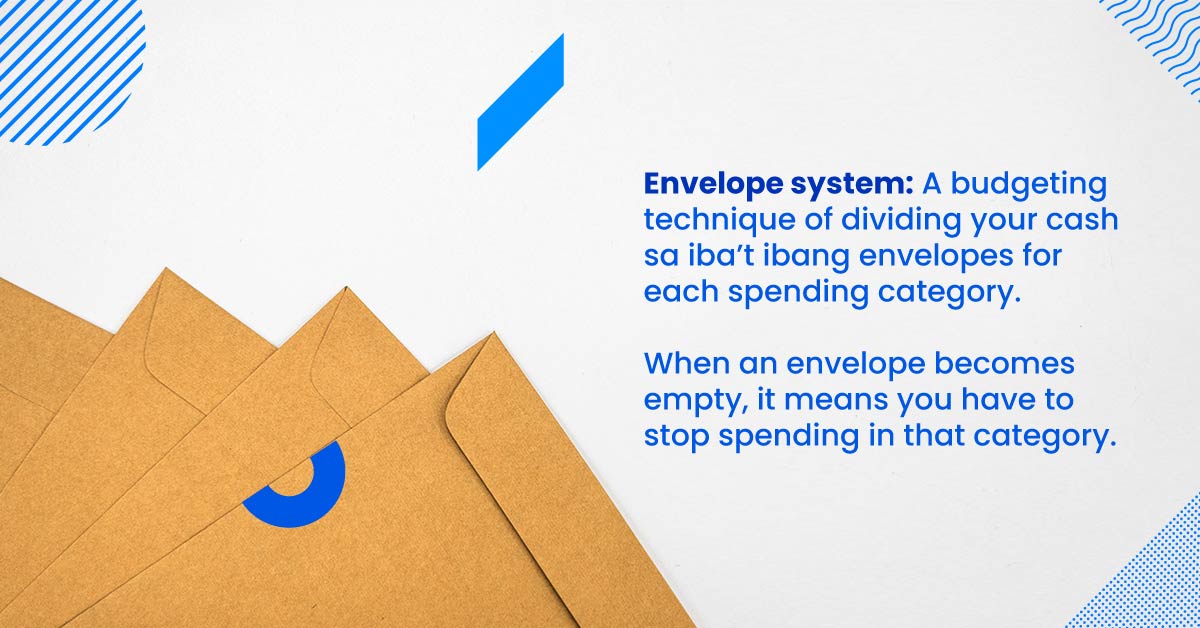

Still not confident na masusunod mo ang iyong budget? Then pwede mong i-adopt ang envelope system.

Finally, be patient with yourself at huwag sumuko when you overspend! First, you can simply move money from other categories to cover emergency spending. Second, you can make an allowance next month specifically for emergency spending. If the expense really can’t wait at short na ang iyong current finances, then look into credit options. Maraming accessible credit options that you can quickly repay to stay on track, such as GCredit.

Always remember that the goal of budgeting is to make your expenses equal to your income. By slowly and surely learning this habit, you’ll live within your means. Eventually, makakahanap ka rin ng space in your budget for future financial goals!